GBP to Face BoE Governor Carney- Gold Outlook Remains Bearish

Talking Points:

- GBP/USD Hit by Scotland Referendum; BoE Governor Carney in Focus

- Gold Downside Targets Remain Favored as Bearish Patterns Remain in Play

- USDOLLAR Strength to Continue as RSI Retains Bullish Momentum

For more updates, sign up for David's e-mail distribution list.

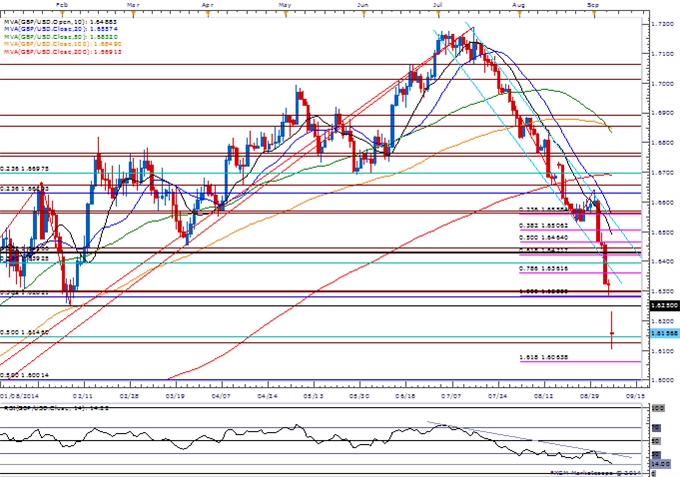

GBP/USD

- GBP/USD gaps to a fresh monthly low (1.6102) as polls show greater risk of Scotland leaving the U.K.; Relative Strength Index (RSI) approaching lowest level since September 2008.

- BoE Governor Mark Carney scheduled to speak tomorrow at 10:45 GMT; will be watching former support zones for new resistance: 1.6250, 1.6280-1.6300 and 1.6360-90.

- Even though the DailyFX Speculative Sentiment Index (SSI) has narrowed to +1.79, appears as though short positions have been hit following the opening weekly gap to the downside; will look for a push back above +2.00 to favor a more bearish outlook.

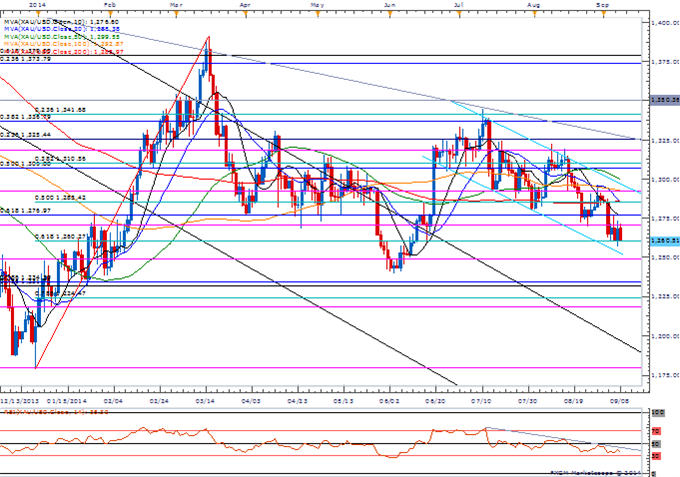

XAU/USD

- Gold appears to be getting ready for another decline as it struggles to push back around $1,270-$1,2706 while RSI retains bearish momentum.

- Market participants still appear to be treating bullion more so as a commodity rather than a currency as it moves in tandem with Silver prices.

- Need close below $1,260 (61.8% retracement) to look for a more meaningful run at $1,250, which will be followed by $1,231-$1,234.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

Read More:

EUR/USD Aims for 1.2750, GBP/USD Clear Critical 1.6260 Level

British Pound Sinks as Scottish Independence Poll Fuels Capital Flight

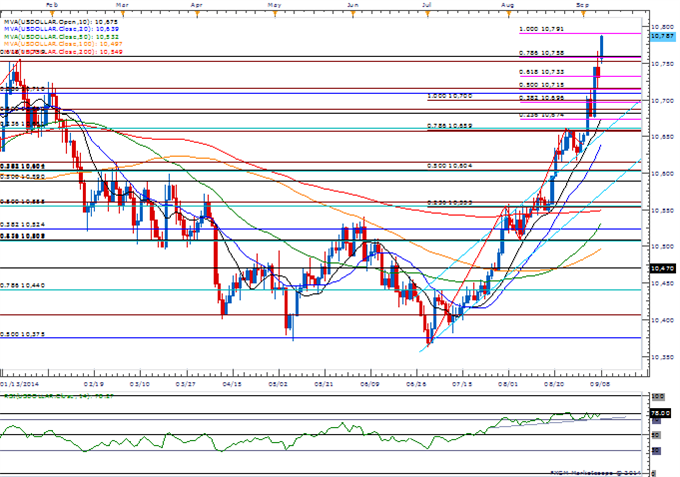

USDOLLAR(Ticker: USDollar):

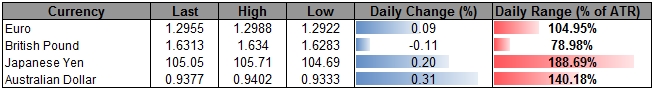

|

Index |

Last |

High |

Low |

Daily Change (%) |

Daily Range (% of ATR) |

|

DJ-FXCM Dollar Index |

10787.13 |

10789.72 |

10749.73 |

0.48 |

116.49% |

Chart - Created Using FXCM Marketscope 2.0

- Dow Jones-FXCM U.S. Dollar Index gaps higher & rallies to a fresh 2014 high of 10,781; topside targets remain favored as RSI holds above 70 & pushes deeper into overbought territory.

- DailyFX SSI shows retail positioning remains net-short on the U.S. dollar; may see resumption of recent trends should we see a further build up.

- Next topside objective comes in around 10,791 (100% expansion) to 10,809 (September 2013 high)..

Join DailyFX on Demand for Real-Time SSI Updates!

|

Release |

GMT |

Expected |

Actual |

|

Consumer Credit (JUL) |

19:00 |

$17.275B |

Click Here for the DailyFX Calendar

--- Written by David Song, Currency Analyst

To contact David, e-mail [email protected]. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

Indonesia

Indonesia