EUR/USD to Eye Former Support Zones on Dismal U.S. CPI

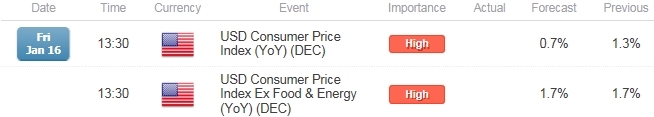

- U.S. Consumer Price Index (CPI) to Mark Slowest Pace of Growth Since 2009.

- Core Rate of Inflation to Hold at Annualized 1.7% for Second Month.

For more updates, sign up for David's e-mail distribution list.

Trading the News: U.S. Consumer Price Index (CPI)

A marked slowdown in the U.S. Consumer Price Index (CPI) may trigger a short-term squeeze in EUR/USD should the development dampen the Federal Open Market Committee’s (FOMC) scope to normalize monetary policy sooner rather than later.

What’s Expected:

Click Here for the DailyFX Calendar

Why Is This Event Important:

Despite expectations for a rate hike in mid-2015, the Fed may sound increasingly cautious and preserve its highly accommodative policy stance beyond schedule as the central bank struggles to achieve its mandate for price stability.

Expectations: Bearish Argument/Scenario

|

Release |

Expected |

Actual |

|

Advance Retail Sales (MoM) (DEC) |

-0.1% |

-0.9% |

|

Average Hourly Earnings (YoY) (DEC) |

2.2% |

1.7% |

|

Durable Goods Orders (NOV) |

3.0% |

-0.7% |

Subdued wages along with the recent slowdown in private sector consumption may prompt U.S. firms to further discount consumer prices, and a weak inflation print may undermine the bullish sentiment surrounding the dollar as it drags on interest rate expectations.

Risk: Bullish Argument/Scenario

|

Release |

Expected |

Actual |

|

Producer Price Index ex Feed, Energy (YoY) (DEC) |

1.0% |

1.1% |

|

NFIB Small Business Optimism (DEC) |

98.5 |

100.4 |

|

Gross Domestic Product (Annualized) (QoQ) (3Q F) |

4.3% |

5.0% |

Nevertheless, improved business confidence paired with the pickup in economic activity may limit the downside risk for price growth, and the stickiness in core inflation may heighten the appeal of the greenback as a growing number of central bank officials show a greater willingness to normalize monetary in 2015.

Join DailyFX on Demand for Real-Time SSI Updates Across the Majors!

How To Trade This Event Risk(Video)

Bearish USD Trade: U.S. CPI Slips to Annualized 0.7% or Lower

- Need to see green, five-minute candle following the release to consider a long trade on EURUSD

- If market reaction favors a bearish dollar trade, buy EURUSD with two separate position

- Set stop at the near-by swing low/reasonable distance from entry; look for at least 1:1 risk-to-reward

- Move stop to entry on remaining position once initial target is hit; set reasonable limit

Bullish USD Trade: Inflation Report Exceeds Market Forecast

- Need red, five-minute candle to favor a short EURUSD trade

- Implement same setup as the bearish dollar trade, just in the opposite direction

Potential Price Targets For The Release

EUR/USD Daily Chart

Chart - Created Using FXCM Marketscope 2.0

- EUR/USD remains at risk for a further decline as long as the RSI pushes deeper into oversold territory.

- Interim Resistance: 1.1840-50 (50% expansion)

- Interim Support: 1.1500 pivot to 1.1565 (weekly low)

Read More:

Price & Time: A Central Bank Blinks

Retail FX Remains Net-Long EUR/USD Ahead of U.S. CPI, ECB Meeting

Impact that the U.S. CPI report has had on EUR/USD during the last release

|

Period |

Data Released |

Estimate |

Actual |

Pips Change (1 Hour post event ) |

Pips Change (End of Day post event) |

|

NOV 2014 |

12/17/2014 13:30 GMT |

1.4% |

1.3% |

0 |

-116 |

November 2014 U.S. Consumer Price Index

The U.S. Consumer Price Index (CPI) slowed to an annualized rate of 1.3% from 1.7% in October on the back of falling energy prices, with the core rate of inflation narrowing to 1.7% from 1.8% during the same period. Indeed, subdued price pressures raise the risk of seeing the Fed further delay its first rate hike, but it seems as though the central bank will normalize monetary policy in 2015 as the committee anticipate the drop in oil prices to have an positive impact on the real economy. Despite the initial tick higher in EUR/USD, the dollar remained resilient against its European counterpart as the pair slipped below the 1.2400 handle during the North American trade to end the day at 1.2343.

--- Written by David Song, Currency Analyst and Shuyang Ren

To contact David, e-mail [email protected]. Follow me on Twitter at @DavidJSong.

To be added to David's e-mail distribution list, please follow this link.

Trade Alongsidethe DailyFX Team on DailyFX on Demand

Looking to use the DailyFX Trade Signals LIVE? Check out Mirror Trader.

New to FX? Watch this Video

Join us to discuss the outlook for the major currencies on the DailyFXForums

original source

Indonesia

Indonesia